VA Loan vs Conventional Loan

There’s some confusing information out there about the VA loan program. If I’m an eligible veteran, should I finance my home purchase with a VA loan? Is a conventional mortgage a better deal for me? Does a VA loan have higher costs?

Spoiler alert: the VA loan program is virtually always the best option for anyone eligible with less than 15% available for a down payment.

Comparison: VA loans vs. conventional loans

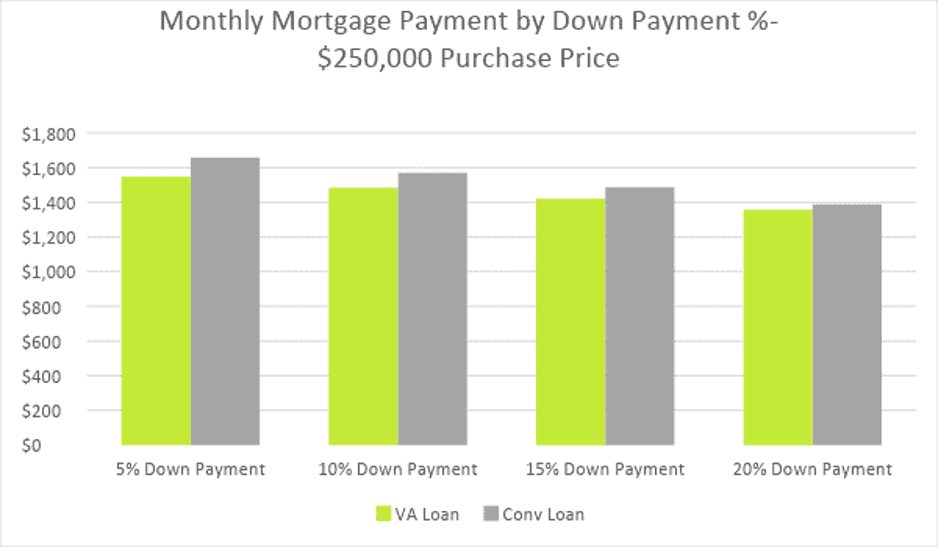

Let’s start with the chart below comparing the total mortgage payment on a VA loan vs Conventional loan for a purchase of $250K at several down payment levels. As you can see, the VA loan has a lower monthly payment at every down payment percentage. The key difference is that a VA loan typically carries an interest rate that is .375 percentage points lower than Conventional, and sometimes more depending on credit score. Please remember: the VA loan program does not require any down payment. Unlike a conventional loan, you can have zero down payment with VA and still get a fixed rate.

What is the difference between a conventional and VA loan?

VA loans and conventional loans may seem similar on the surface. A VA mortgage has a better interest rate, no down payment, no mortgage insurance – what’s not to like?

However, if you factor in things like the VA funding fee and perhaps putting enough money down on a conventional mortgage to avoid mortgage insurance, the choice may become more complicated.

Taking into account the following factors can help you decide whether to get a Department of Veterans Affairs loan or a conventional loan.

VA Loans have several advantages

Financial professionals often say that VA loans are one of the best mortgage options available to homebuyers. Most of the time, they are right.

These mortgages are backed by the US Department of Veterans Affairs. Even if foreclosure is completed, the lender will still receive some money. By assuming less risk, your mortgage lender passes that savings along to you in a number of ways.

Zero Down Payment

One of the biggest benefits of a VA loan is that you typically don’t have to make a down payment. Although conventional mortgage lenders traditionally preferred bigger down payments, these days you can get a home loan with a down payment as low as 3%.

What about fees for VA loans?

In reality, RMN charges zero extra fees on a VA loan compared to Conventional or any other product. Some lenders may charge an increased origination fee on VA loans, but with RMN, your closing costs will remain the same across the board. With our quick in-house underwriting and consistently low costs, our only motivation in suggesting one loan option over another is helping you find the best deal possible.

But what about private mortgage insurance?

I heard that VA loans have high mortgage insurance compared to Conventional financing.

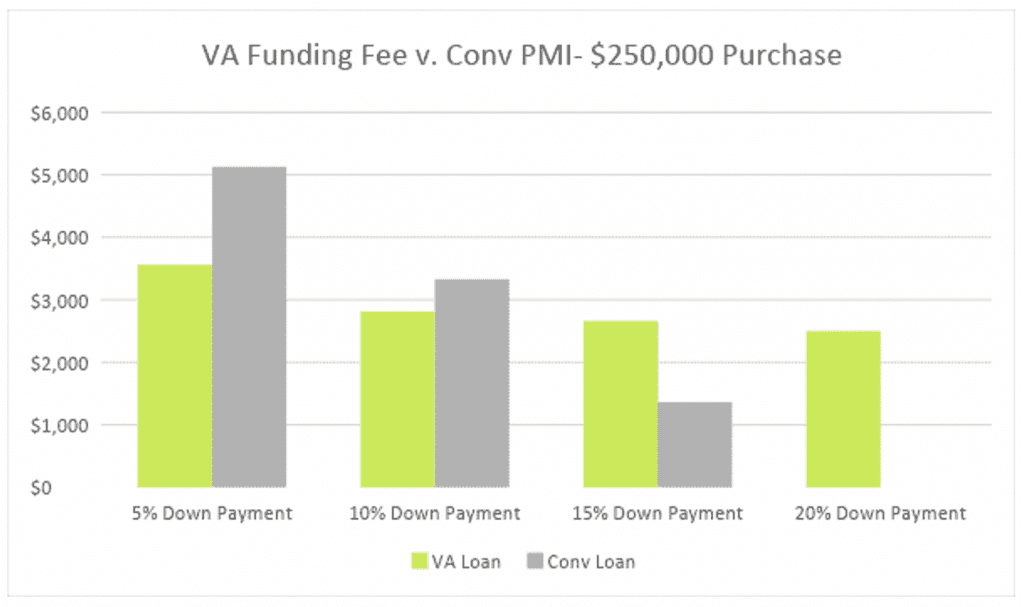

VA loans have no monthly mortgage insurance but sometimes have a funding fee, which essentially serves the same function as upfront PMI on a conventional loan. Please note: a veteran is EXEMPT from the VA funding fee if he or she has at least a 10% service-connected disability rating. In the event the veteran is not exempt, below is a chart comparing the VA funding fee against upfront PMI on a conventional loan. As you can see, the VA funding fee compares favorably to Conventional PMI if you are planning to put down less than 15%. Unlike PMI, the VA funding fee can be rolled into your loan amount, meaning there’s no out-of-pocket expense at closing.

Credit score requirements are low.

You are more likely to be approved for a VA loan than for a conventional loan.

There is no minimum credit score specified by the VA. The mortgage lender determines the credit score required.

Additional VA Loan Benefits

- Flexible rate options: A variety of terms are available, including 15, 20, and 30 years.

- Prepayment penalties are not applicable: Refinancing or paying down your loan whenever you desire will not incur a penalty.

- Loan limits no longer exist: There are no longer any VA loan limits, so your loan’s size is only determined by the VA lender’s maximum. This means that qualified borrowers can now obtain jumbo VA loans under the same terms as existing VA loans.

- Comparison shopping is allowed: A portion of your VA loan is guaranteed, but the remainder is financed through a private lender. This allows you to compare lenders and rates to get the best loan.

- Low closing costs: VA loans may well have lower closing costs than other types of mortgages due to certain closing cost caps.

- Streamline refinance option: When you refinance your home with this loan option, you don’t have to take money out of your house. You can go through the process quickly, cheaply, and easily.

When a VA Loan May Not Be the Right Choice

Ineligibility is the biggest drawback for most Americans. Certificates of eligibility are required for VA loans, and they can only be obtained by service members who meet certain requirements.

VA Funding Fee

Upon closing, a VA funding fee is paid in a lump sum as a percentage of the home loan. As a first-time borrower with a down payment of 0% to 5%, you will need to pay 2.3% of the loan amount. However, this increases to 3.6% if you use a VA loan more than once.

Although the VA home loan funding fee is not small, it allows the program to be self-sufficient. Despite its size, the fee allows the Department of Veterans Affairs to offer zero down payment loans without mortgage insurance.

Usually, the VA funding fee can be financed into your mortgage so that it becomes part of your monthly payment. There is no doubt that this is not a small fee, but it should be much less costly than the mortgage insurance you would have to pay if your loan had a low down payment.

Occupancy and Property Type

The type of property you are buying is a major determinant of whether to get a VA loan or a conventional loan. VA loans are only available for primary residences. Typical conventional loans can be used to purchase primary homes, second homes, or even rental properties.

Property Requirements

The VA relies on HUD guidelines for property requirements. These minimum standards are called the VA’s Minimum Property Requirements. If you are buying a home, it must already comply with these regulations or undergo renovations so that it will comply by the time you move in.

Roof life and chipped/peeling paint are the most common items but these items can also be called out by conventional appraisers if they look like they need to be addressed.

What are the advantages of conventional vs VA loans?

Freddie Mac and Fannie Mae typically purchase conventional loans that meet the requirements to be conforming loans.

In general, conventional conforming loans:

- Require at least a 3% down payment

- If you put down 20% or more, there is no mortgage insurance charge

- Credit scores of 620 or higher are required, but the higher your score, the lower your rate is likely to be.

- Open to all legal US residents regardless of military service

- Any residential property can be bought with this loan, including vacation and investment properties

With a down payment of at least 20 percent, conventional loans can be the best option. With conventional loans, there is no upfront funding fee.

Which is better for you: VA Loan vs Conventional Loan

Unless you’re concerned about the VA’s debt-to-income ratio threshold, funding fee, occupancy requirements, or property requirements, a VA mortgage loan is likely to be the best choice for your home purchase.

Are you or someone you know eligible for a VA loan? You can reach out at any time or start a live chat with us (click the chat button at the bottom-right!) to learn more about the VA program or the mortgage process.

Start The Conversation