VA Loan v. Conventional Loan Programs for Veterans

There’s some confusing information out there about the VA loan program. If I’m an eligible veteran, should I finance my home purchase with a VA loan? Is a Conventional mortgage a better deal for me? Does a VA loan have higher costs?

Spoiler alert: the VA loan program is virtually always the best option for anyone eligible with less than 15% available for down payment.

Let’s start with the chart below comparing the total mortgage payment on a VA loan v. Conventional loan for a purchase of $250K at several down payment levels. As you can see, the VA loan has a lower monthly payment at every down payment percentage. The key difference is that a VA loan typically carries an interest rate that is .375 percentage points lower than Conventional, and sometimes more depending on credit score. Please remember: the VA loan program does not require any down payment. Unlike a Conventional loan, you can have zero down payment with VA and still get a fixed rate.

But what about VA loan mortgage insurance?

I heard that VA loans have high mortgage insurance compared to Conventional financing.

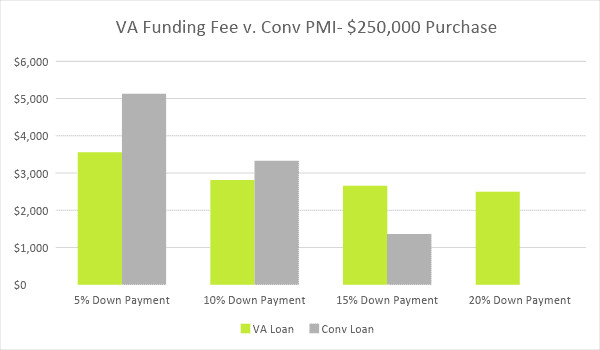

VA loans have no monthly mortgage insurance but sometimes have a funding fee, which essentially serves the same function as upfront PMI on a Conventional loan. Please note: a veteran is EXEMPT from the VA funding fee if he or she has at least a 10% service connected disability rating. In the event the veteran is not exempt, below is a chart comparing the VA funding fee against upfront PMI on a Conventional loan. As you can see, the VA funding fee compares favorably to Conventional PMI if you are planning to put down less than 15%. Unlike PMI, the VA funding fee can be rolled into your loan amount, meaning there’s no out of pocket expense at closing.

What about fees for VA loans?

In reality, RMN charges zero extra fees on a VA loan compared to Conventional or any other product. Some lenders may charge an increased origination fee on VA loans, but with RMN, your closing costs will remain the same across the board. With our quick in-house underwriting and consistent low costs, our only motivation in suggesting one loan option over another is helping you find the best deal possible.

Are you or someone you know eligible for a VA loan? You can reach out at any time or start a live chat with us (click the chat button at the bottom-right!) to learn more about the VA program or the mortgage process.

Start The Conversation