Adjustable Rate Mortgage – A Trick or a Treat?

It’s no secret that all of us at RMN are passionate about offering fixed rate financing for our borrowers. However, it’s important for you to understand exactly WHY we are such proponents of fixed rates.

After all, “What’s the harm if I get an adjustable rate mortgage (ARM) from my local bank? It has the lowest rate of all the mortgage options I was offered, and my plan is to move out and sell the house before the rate adjusts in 5 years. Even if not, my bank tells me an ARM is a great option for people like me who expect their income to increase in the next 5-10 years. So I’m good right?”

Well, this is a great sales pitch, but getting into an ARM is a significant risk – one you simply shouldn’t take if you qualify for a fixed rate mortgage.

Market Risks

Before we get into the benefits of choosing a fixed rate product, let’s take a step back and look at the presence of ARMs in the marketplace throughout the entire country. A recent study by the Mortgage Bankers Association found that ARMs accounted for only 6.7% of all mortgage originations in the United States. Wow, only 6.7%? That seems telling. The truth is that an ARM creates significant risk exposure for a borrower, and in our current economy, should only be used out of necessity. Clearly the rest of the country is well aware of adjustable rate risk, but for some reason, there’s a glaring lack of education in our market here in Iowa.

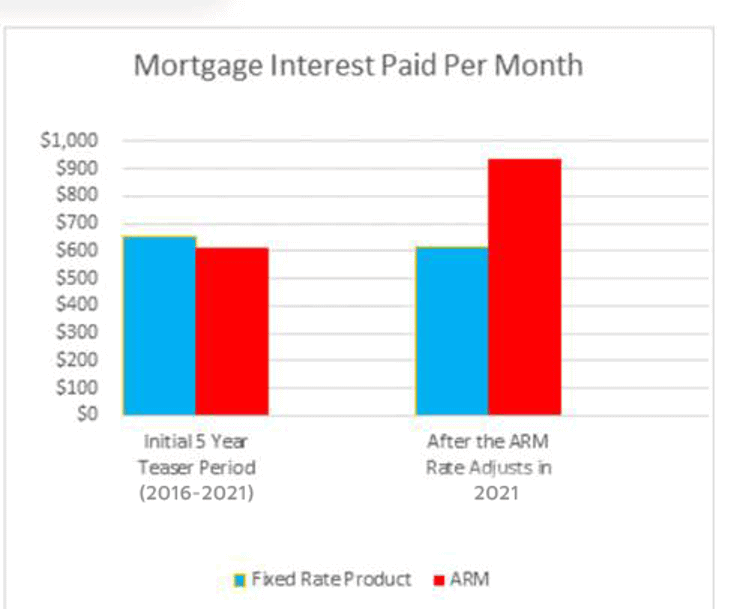

“Ok, so why exactly is a fixed rate mortgage a less risky option?” Take a look at the graphic below. This illustration shows an example of the consequences of a borrower who was deciding between a fixed rate loan v. an ARM 5 years ago in 2013. During this time, rates were at their all-time low, and it was common for a home buyer borrowing $265,000 to be offered an ARM with an initial rate of 3.000% v. a fixed rate product at 3.125%. All else equal, the only difference between the two loan products is the amount of interest paid each month by the borrower.

In the graph, you’ll see that the adjustable rate mortgage resulted in savings of $27/month on average during the first 5 years of the loan. However, on the right you’ll see the updated payment comparison in 2021 after the ARM adjusted to today’s interest rate. The ARM borrower is now paying $319/month more than the fixed rate borrower PURELY IN INTEREST! $319. EVERY MONTH. For the ARM borrower, it will only take 5 months for the new ARM payments to wipe out every penny of savings provided by the ARM during the initial 5 year period. It’s also important to remember that most ARMs reset every year, so the $319/month payment difference may very well continue to increase year after year. Your bank telling you that an ARM is fine because your income will increase is essentially their way of saying, “who cares that you’ll be throwing money away in 5 years — at least you’ll probably be able to afford it.” I don’t know about you, but I can think of several things I’d rather do with my money than pay extra mortgage interest for no reason.

Why Choose A Fixed Rate?

Despite recent increases, interest rates remain at a historically low figure. More importantly, virtually all economic projections anticipate continued rate increases in the future. “Okay, but what does that mean for me?” Well, pretty much every expert in the world is betting that if you get an ARM now, you will end up paying hundreds and hundreds of dollars in additional interest per month when the teaser rate expires in 5 years. It just doesn’t make any sense to take this risk when the reward is only a few bucks per month.

“But an ARM rate adjustment won’t affect me, as I plan to sell my new house within the next 5 years.” Life is uncertain. Things happen and plans can change in an instant. What if you decide you want to move into a new house in 5 years, but you’d also like to keep your current home and rent it out? Wouldn’t it be nice if you could continue to finance the home with a low interest rate that is locked in for another 25 years? Secondly, if rates actually do increase as much as many expect, you might not be so excited about buying a new house and paying interest that’s 1, 2, or maybe 3 percentage points greater than your current home loan. You might wish your current interest rate was fixed so you could simply stay in your present house and continue taking advantage of the great low interest rate.

Fixed Rate Condo Financing

Most lenders will ONLY offer an ARM for condominium financing which will cost you more in the long run. You can finance with a fixed rate mortgage for a condominium with a VA loan a Rural Development loan, or a Conventional loan if the condo project meets program requirements. The majority of condo projects in our market meet the requirements and are eligible for approval. The lender you’re talking to needs to understand how you can get those condo projects approved, and they have to have the authority to submit them for approval.

If you find a condo that you love, reach out to us first to find out if the project is already approved! If it is not, we will need some additional paperwork from the Home Owner’s Association. RMN has gotten hundreds, if not thousands, of condos approved all over the state of Iowa including Iowa City, Cedar Rapids and surrounding areas. We understand how to approve the condos and how to fit the process into our timeline so that we do not miss any deadlines.

Fixed Rate Government Financing

We’ve heard the horror story dozens of times. A customer goes to another lender in hopes of getting a VA or USDA Rural Development loan and, at the last second, the lender tells them they no longer qualify for that program and their only option is an ARM.

Many buyers, sellers and Realtors don’t understand the important of working with an experienced VA or RD lender until something like this happens and we are called to pick up the pieces. RMN’s entire lending staff is highly trained on the specific requirements of the VA loan program. We are able to detect and resolve potential issues at the front end of the loan process, whereas other lenders may take weeks before a VA underwriter will even review a loan file. We simply walk down the hall to talk to our processors and our underwriters, so things get done immediately. There isn’t a better way to explain it – it is just that easy! That is how we are able to avoid last minute changes like the story described above.

Trust RMN for Your Fixed Rate Financing

Of course, our process remains quick and smooth for any fixed rate financing. Our office has authority to process approvals for any of these programs. If you’ve been told by another lender that an ARM is your best financing option, I encourage you to reach out to our office and get started today!